Energy management

Optimization of grid-scale battery storage system Operation Using Electricity Market Price Forecasting Technology

Overview

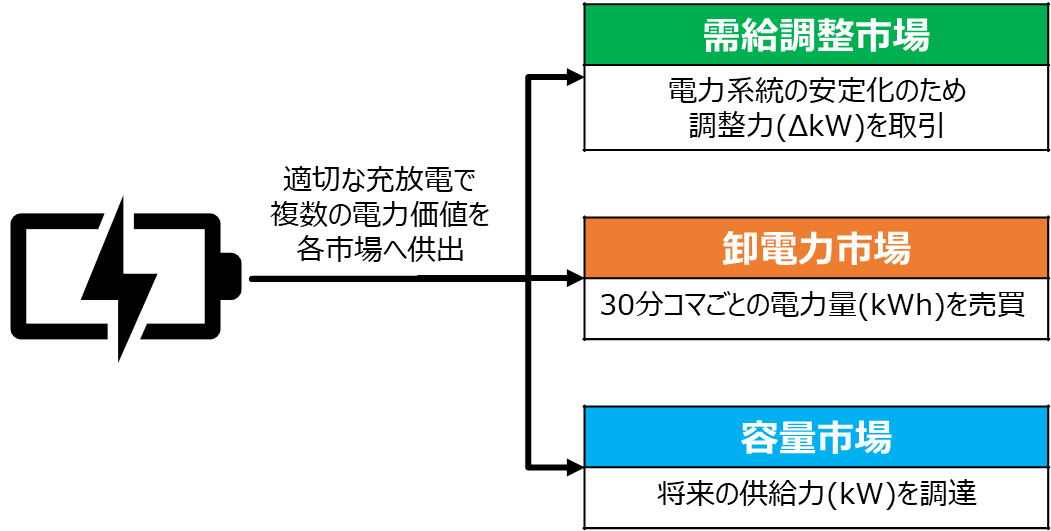

By entering the battery business and optimizing the operation of batteries based on price forecasts for the spot market and other electricity markets (wholesale electricity market, flexibility market, and capacity market), we will contribute to improving the supply and demand balance in the power grid.

Background

Renewable energy sources have been rapidly gaining popularity in recent years, but their output is unstable, and they are viewed as a problem because they disrupt the supply and demand balance of the entire power grid.

To resolve this, it is necessary to adjust power plant output and increase or reduce demand in accordance with the supply and demand balance. Various electricity markets have been established to efficiently provide resources for such adjustments.

Osaka Gas has entered the grid storage battery business and is using a machine learning model to forecast market prices in the spot market and other markets, optimizing its storage battery operation plans to improve profitability through transactions with various electricity markets while stabilizing the grid.

Rendered image of the grid storage battery business

Example of Using Prediction Technology

As an example of the use of forecasting technology, transactions using batteries in the wholesale market and the flexibility market are explained below.

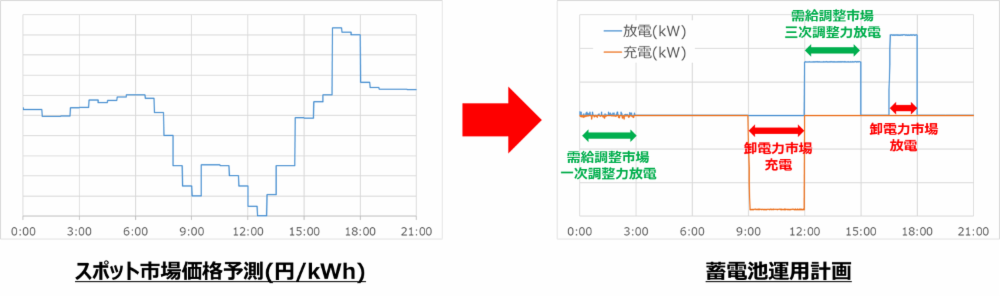

As a premise, in the spot market, which is a type of wholesale market, electricity is traded at a market price set every 30 minutes, and this price fluctuates depending on the balance of supply and demand with time. If you have equipment such as storage batteries, you can charge and discharge them in response to fluctuations in market prices and earn profits from the difference; this is called arbitrage trading.

In addition, in the flexibility market, by discharging the battery at a pre-agreed time period and output, it is possible to earn revenue from the transaction price, which fluctuates according to the market price.

When maximizing profits by combining arbitrage and the balancing capacity market, it is necessary to finely adjust operational plans such as charging/discharging timing/output in response to fluctuations in market prices. This can be optimized by utilizing highly accurate spot market price forecasts.

Optimization of storage battery operation plan

Related contents

TAG SEARCH

- Evolving residential gas appliances

- Evolving residential gas appliances Water heaters, space heaters, dryers Cooking appliances Smart Equipment Fuel Cell systems

- Evolving commercial and industrial gas appliances

- Evolving commercial and industrial gas appliances Cogeneration (CHP) units Air conditioning systems, kitchen appliances Bio, water treatment Industrial furnaces, burners Energy management, IoT

- Enhancing the safety and economic efficiency of LNG regasification

- Enhancing the safety and economic efficiency of LNG regasification Utilization of cold energy Plant materials Power generation technology

- Developing next-generation businesses through enterprising initiatives

- Developing next-generation businesses through enterprising initiatives Materials development Measurement Simulation, data analysis Food science Material evaluation

- Contributing to conserving the environment and achieving a carbon neutral society

- Contributing to conserving the environment and achieving a carbon neutral society Methanation Hydrogen, ammonia Biogas Energy management Renewable Energy

- Technologies of Group companies

- KRI, Inc. Osaka Gas Chemicals Group OGIS-RI Group