Simulation, data analysis

Development of ETRM System for the Electric Power Business

Overview

We are developing an ETRM1 system for managing transactions and risks related to the electricity business.1. Energy trading and risk management (ETRM) refers to various transactions and risk management related to electricity and fuel (coal, oil, gas, etc.).

Purpose

The amount of risk in the power business has increased due to the large fluctuations in fuel market prices and electricity market prices in recent years. In response to this situation, the Ministry of Economy, Trade and Industry (METI) published guidelines on market risk management 2 targeting electricity retailers and power generation companies.

As an electricity supplier engaged in both power generation and retail, Osaka Gas has been working to quantify and visualize risk but has faced challenges such as the difficulty of dealing with increasingly complex transactions, rising operational costs, and the dependency of work on individual tasks. We have developed this system to further enhance our risk management.

ETRM System Functionality

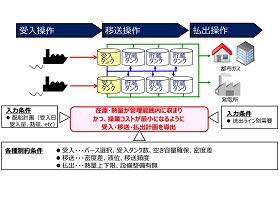

The ETRM system consists of three functions: risk management, transaction information management, and offer management. The risk management function calculates the amount of risk in electricity trading (expected balance, balance fluctuation amount, etc.) based on various kinds of input information. The transaction management function registers information on completed transactions and uses it as input for risk calculations while also managing credit and calculating and managing settlement amounts.

Rendered image of the functionality of the ETRM system

3. The “position” quantitatively clarifies transactions whose quantities and prices are fixed and those which can fluctuate and quantifies the amounts subject to future fluctuations in the market prices of fuel and electricity.

4. EaR is the abbreviation for earning at risk. VaR is the abbreviation for value at risk. It is a quantification of the extent, and the probability, of loss that may occur if prices fluctuate in an unfavorable direction for the company, based on past performance and assuming the probability distribution of future market prices.Each is utilised for risk management in the power generation business and trading operations.

Effects

The ETRM system makes it easier to manage and report on the risk of fluctuations in income and expenditure due to fluctuations in fuel prices and electricity trading prices, as well as to perform risk management and reporting for the trading book. In the future, we plan to further improve the system with the aim of enhancing transaction management and risk management.

Related contents

TAG SEARCH

- Evolving residential gas appliances

- Evolving residential gas appliances Water heaters, space heaters, dryers Cooking appliances Smart Equipment Fuel Cell systems

- Evolving commercial and industrial gas appliances

- Evolving commercial and industrial gas appliances Cogeneration (CHP) units Air conditioning systems, kitchen appliances Bio, water treatment Industrial furnaces, burners Energy management, IoT

- Enhancing the safety and economic efficiency of LNG regasification

- Enhancing the safety and economic efficiency of LNG regasification Utilization of cold energy Plant materials Power generation technology

- Developing next-generation businesses through enterprising initiatives

- Developing next-generation businesses through enterprising initiatives Materials development Measurement Simulation, data analysis Food science Material evaluation

- Contributing to conserving the environment and achieving a carbon neutral society

- Contributing to conserving the environment and achieving a carbon neutral society Methanation Hydrogen, ammonia Biogas Energy management Renewable Energy

- Technologies of Group companies

- KRI, Inc. Osaka Gas Chemicals Group OGIS-RI Group