Upstream Business (U.S.)

The Daigas Group is engaged in upstream businesses that contribute to strengthening and stabilizing the Group’s earnings base by expanding its business portfolio.

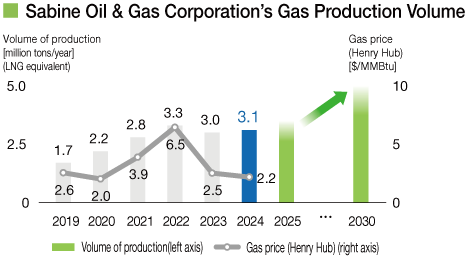

In the U.S., we acquired all shares of Sabine Energy Inc. in 2019, and gained operatorship to proactively promote projects in the shale gas development business. While striving to stabilize earnings through hedging, we are working to maximize earnings by flexibly adjusting production volume and new well development and choosing to acquire or sell assets in response to changes in market conditions such as gas prices (Henry Hub), thereby driving the profit growth of the Group.

Future initiatives

While closely monitoring gas prices, we aim to expand production in the medium to long term by acquiring additional mining areas and expanding development.

Asian Business (India)

The government of India is promoting the expansion of natural gas use, such as encouraging the spread of natural gas vehicles through the development of city gas infrastructure, as a measure to address rising energy demand associated with economic growth, and to promote low carbonization and address air pollution.

Therefore, growth is expected in the Indian market. In 2021, the Daigas Group became the first Japanese company to participate in the Indian city gas business through investment in a local city gas business company.

In the business area in which we have been granted exclusive business rights by the Indian government, we will expand sales of city gas for residential, commercial, and industrial use with focus on transportation, and develop it into a pillar of our Asian business, in order to contribute to the transition to low-carbon energy and the stable energy supply in India.

Future initiatives

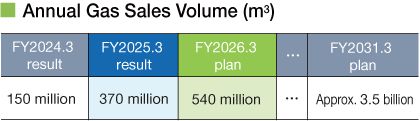

We aim to expand our annual sales volume to approximately 3.5 billion m3, equivalent to roughly half of Japan’s city gas sales volume, in FY2031.3, and establish a medium- to long-term earnings base.

Through a Japanese consortium, we will establish a joint venture with an Indian renewable energy business company and own approximately 400 MW of renewable energy assets in three years, thereby contributing to the decarbonization of energy.